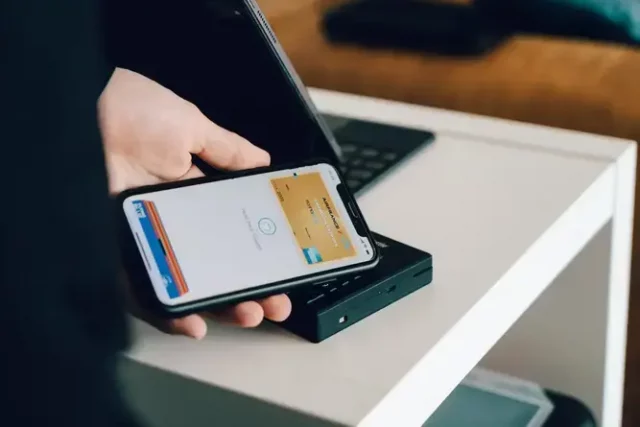

The usage of digital payments has advanced rapidly in recent years. Digital or online payment services have become a noteworthy topic in the financial industry. Such payment methods function seamlessly with online browsers, in-app, and mobile devices, accelerating innovation in various fields, from banking to fintech companies. Digital wallets or e-wallets have become a crucial part of this era. In this blog, we will discuss the rise of digital wallets and their impact on Banking sectors.

What are digital wallets?

Before discussing the rise of digital wallets and their impact on the banking system, let’s have a quick look at what digital wallets are. Digital wallets are an easy and secure method of storing and managing payment information. Individuals can conveniently transfer money from one bank account to another as an easy and safe alternative to the physical wallet.

Types of Digital Wallets

Digital wallets have a significant role in the digital payment system. There are multiple types of digital wallets available. Below, we will discuss three primary digital wallet types-

- Open wallets – The open digital wallets are type e-wallet only a bank or institute can issue by partnering with another prominent bank. The open wallets work similarly to the semi-closed wallets, but individuals can also withdraw money from ATMs with these wallets.

- Semi-closed wallet – Semi-closed is another type of digital wallet that allows individuals to make transactions under listed stores and merchants’ accounts. The semi-closed wallet can help you make both online and offline payments.

- Closed wallet – Closed wallet is a company-issued e-wallet to deal with services or products. They allow users to execute transactions with the wallet’s issuer or other users. Exp. Amazon Pay.

Features of digital wallets

Here are some primary features of a digital wallet-

- Easy to register

- Seamless payment process

- QR technology-based system

- Flexible and user-friendly

- Real-time assistance

Importance of digital wallets in banking

No wonder e-wallets or digital wallets have become a considerable part of modern-day money transactions. And the main reason behind this is the accelerating growth of digital marketing. A recent study shows that the total mobile wallet transactions in India in the four quarters of 2017 reached approximately 3.61 billion USD. Here are some reasons why digital wallets have become so crucial for digital payments in the banking industry-

- Digital wallets help to cut off the chances of fraud and security threats (involved in physical transactions), making them a secure option for money transactions, including bank transactions.

- Digital wallets facilitate users to conduct safer, faster, and more convenient transactions. You can use it to transact funds between two organisations, individuals, or individuals and organisations, which changes the traditional banking system.

- The e-wallets end the demand to bear a physical wallet or money for dealings, making financial transactions easy and hassle-free.

- With digital wallets, people also do not need a traditional bank account for money transfers, which leads to a drastic transformation in the conventional banking system.

Conclusion

Digital wallets or e-wallets are the fruits of modern payment or money transaction systems. It is a software-based system that enables users to perform electronic transactions to pay bills, purchase products/services, lend or return money (digitally), and so on. Digital wallets make payment methods and money transactions simple, secure, hassle-free, and convenient. It also resulted in a paradigm shift in the banking system and changed the definition of traditional banking. In this blog, we have discussed the rise of digital wallets and their impact on the standard banking system.